Target Hits Bullseye with Boosted Retail Sales

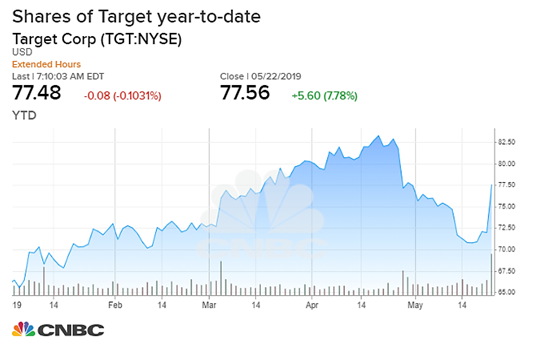

As of Wednesday, May 22, Target reported that upon the quarter’s close on May 4, same-store sales rose 4.8% Quarter over Quarter. Brian Cornell, the Chief Executive of the Minneapolis-based retailer, has revealed that Target’s sales activity is growing at a faster rate than the overall market, thus resulting in significant gains for shareholders. Whereas Wall Street expected earnings per share (EPS) of $1.43 on revenue of $17.52 billion, Target reported earnings per share of $1.53 on revenue of $17.63 billion. Equally important, digital sales swelled by 42% Quarter over Quarter in 2019, which accounts for the majority of the aforementioned comparable sales growth. The retail giant’s same-day distribution epitomizes a consumer-centered culture and has further boosted traffic and sales. Earlier in the week of May 20, major retailers exhibited faltering sales, with Kohl’s (KSS) and J.C. Penny (JCP) down by 3.4% and 7.91%, respectively. In fact, Target has Walmart beat, even though its competitor reported that “U.S. Q1 comp sales grew 3.4% and Walmart U.S. eCommerce sales grew 37%.”

Jim Cramer, host of CNBC’s television program Mad Money since 2005, hails Target’s emergent delivery service and small-format retail locations as “nothing short of astounding…They’ve figured out to beat all their opponents, from Walmart to Amazon to everyone inside and outside the mall.” In December of 2017, Target acquired a personal shopping and delivery service called Shipt for $550 million. Shipt is a membership-based service where, for $99 annually, customers can order online from nearby stores and Shipt shoppers pick up and deliver the products on the same day. Cramer acknowledges the similarity in business model to that of Amazon Prime; however, he underscores that Shipt is “cheaper and better.” The acquisition was historically one of the big-box store’s largest deals and fueled the broadening of its distribution channels. Target customers can order from 1,500 locations across 250 product markets and receive said items within hours. Moreover, 1,250 store locations provide curbside pickup services, a feature that the “AMAZN boogeyman” does not offer. In addition to putting retail locations at the center of Target’s fulfillment system, a 2017 $7 billion capital investment plan allowed the giant to remodel 400 locations between 2017 and 2018.

Last year, the retailer focused on downsizing its store model to attract young shoppers and access customers in urban regions of the U.S. As a matter of fact, stores have made storefronts more welcoming and its integral Starbucks cafés sleeker as a means of enticing customers and bolstering traffic in retail establishments. The appearance of core departments such as apparel and cosmetics, electronics, and grocery have been spruced during remodels, while more store space has been reallocated to these product categories. However, remodeling is not limited to physical in-store arrangements. Cornell has revealed that Target is aiming to infuse ingenuity and innovation into the business model through an aggressive investment agenda, revitalized brand portfolio, and reconceived supply chain (“Walmart, Target,” 2019). In line with Target’s growing digital sector, which represented 7.1% of sales in 2018, the company is elevating the customer experience by integrating technological advancements. By the end of 2019, Target plans to open 130 scaled-down brick-and-mortar locations that stand at 40,000 square feet, whereas traditional stores are over 100,000 square feet. Despite new distribution channels, Target is dedicated to its brick-and-mortar facilities, since Cornell revealed to retail analysts that “at the end of the day, the majority of guests go to stores” (‘Walmart, Target,” 2019).

As of Thursday, May 24, J.P. Morgan upgraded its neutral rating on Target stock to overweight, boosting the target price from $81 to $100. Despite the leviathan that is Amazon and its attempts to devour global business, J.P. Morgan retail analyst Christopher Horvers disclosed that Target need not outmaneuver Amazon in order to be revalued. Instead, the retailer must surpass fellow home and apparel retailers, such as specialty home retailers, mall-based retailers, and department stores. Compared to the first quarter results of other large-cap retailers, Target’s previously mentioned 4.8% growth rate exceeds the majority of competitors, for Lowe’s, TJX, and Home Depot are growing at 4.2%, 5%, and 3%, respectively.

By the same token, J.P. Morgan has three categorical “buckets” for retailers, and the bank is arguing that Target move from the second bucket to the first. The first bucket consists of expensive, low Amazon-risk stock with “best-in-class” gains. Companies with dubious margin and growth projections fall into the second bucket, while “structurally impaired” organizations dominate the third bucket. According to the bank, Target’s stock price warrants a re-evaluation because, over the past 12 months, shares are up approximately 9% and over 17% year-to-date.

Moreover, Target, with its market capitalization of $41 billion, ranks number 2 out of 5 broadline retailers in the United States (“Stock review: Target,” 2019). Many discount retailers fall into the second bucket, including BJ’s Wholesale Club, Walmart, and Costco, for they offer cheaper product lines and distribute at high volumes. Target ranks 102 out of the 363 stocks in the S&P 500 Index and 110 of the 2,085 stocks in the Total NYSE market. Considering that the retailer “posted the highest rise in MCap with the most influence on the Broadline retailers sector,” J.P. Morgan’s call for re-evaluation appears warranted.

8.6 Rank of Target in the S&P 500 Index [out of 363 stocks], in the Total NYSE Market [out of 2085 stocks] and in the Broadline retailers sector [out of 5 stocks]

CEO Brian Cornell has led Target’s success for nearly five years, and he credits the retail giant’s superior performance to the fact that “at Target, we perform best when we’re pursuing our own path, not when we’re chasing someone else.” However, the trade war with China has bred concern, considering that Target is a major Chinese importer. Cornell has assured investors that higher operating costs will not significantly impact a single retail category, rather, the impact is diversified across different product areas. As of October, a 10% duty was imposed on $200 billion in Chinese goods; however, the Trump administration raised the tariff to 25% earlier this month. Thus far, primary consumer categories have evaded tariffs and shielded American shoppers from bracing the full impact of the U.S.-China trade war. Yet, Target’s excessive spending has caused certain analysts at Morgan Stanley to speculate that the company could face long-term gross margin pressure. Despite external pressures, Target expects to meet analyst predictions on fiscal year earnings.

Works Cited

Stock Review: Target Adds $US459.5 million in MCap, Top Heavyweight Rise in Broadline

Retailers Sector. (2019). Retrieved from http://ezp.bentley.edu/login?url=https://search-proquest-com.ezp.bentley.edu/docview/2229453542?accountid=8576

Walmart, Target Embrace the Challenge from Amazon. (2019). Chain Drug Review, 41(7), 79.

Retrieved from

http://search.ebscohost.com.ezp.bentley.edu/login.aspx?direct=true&db=bth&AN=136391240&site=bsi-live

![8.6 Rank of Target in the S&P 500 Index [out of 363 stocks], in the Total NYSE Market [out of 2085 stocks] and in the Broadline retailers sector [out of 5 stocks]](https://images.squarespace-cdn.com/content/v1/5acea5f9f2e6b1da315acf14/1559569457146-E5LJXB0L018RH19GFPPQ/spielman_target_3.png)