Short Tempers

When people discuss the most valuable brands in the world, they often come up with very similar lists, and it’s easy to see why. They look in their pockets and see Apple (often serviced by AT&T). They pull out a laptop and it’s either running Windows or iOS (powered by Intel). Google is the portal to the internet, Netflix is the new Home Box Office, and Amazon is increasingly dominating every corner of the world. More and more Teslas are roaming our streets (surprisingly, considering their manufacturing problems), and Disney produces blockbusters every other month. Besides being incredibly valuable and innovative, these companies have another similarity: they are some of the most shorted stocks in the world. But why? What about these valuable companies draws the ire of investors and leads bets against their future performance?

Before we can answer that question, we need to understand what short-selling is. Shorting a stock is essentially “borrowing” a share of a company, selling it for today’s price, and agreeing to deliver one share of stock to the owner by or on a certain date. The profit to the short-seller is the difference between the prices of the borrowed share and the returned share. The more the price of the stock drops, the more profit accrues to the short-seller. However, if it rises, they incur losses, as they still need to deliver shares of the company, despite the higher price. The actual practice of shorting is somewhat more complicated, with having to maintain certain margin and maintenance accounts, but the process is all that’s essential to understand.

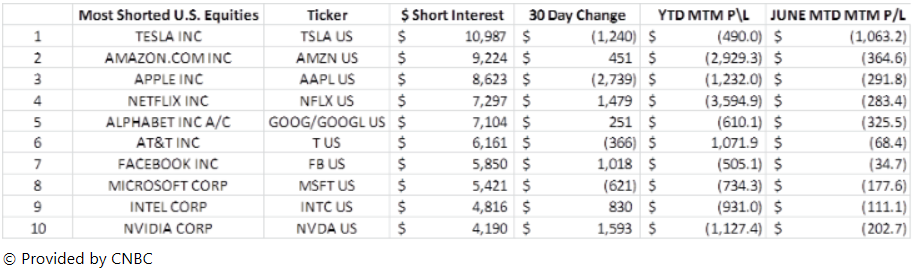

Now, some might say it’s foolish to bet against a bull market, and there’s undoubtedly merit to that argument. According to Hedge Fund Research LLC, the short-only fund ETFs lost 10% in 2017, and have had only one positive year, a gain of 1.22% in 2016, since 2013. Below, we can see not only the most shorted stocks, but also the amount short-sellers have lost on their positions (in millions). All are highly negative, as one would expect.

Two crucial headwinds are working against the shorting industry: historically high price-to-earnings ratios and increasing M&A activity. Investors are becoming accustomed to the high P/E ratios in the industry, adjusting expectations to find “value” within the new normals. Even private equity firms are increasing their activity, despite high valuations, by innovating to create value. These combine to force general market prices up, a tough situation for short-sellers relying on specific firms to drop.

The second headwind, M&A activity, is similar. Many companies recognize their stock could be overvalued, given market trends. What’s more, the market is thought to be in the latter stages of expansion, meaning the overvaluation can only continue for so much longer. So, this lends an incentive to buy companies using this stock, increasing M&A activity. It also means that weaker or “problem” companies are more likely to be acquired for strategic reasons, thus pushing up the targeted company’s stock price. This also makes it hard for short-sellers to profit, as they need to navigate around these companies involved in M&A. Even if they correctly identified an overvalued “problem” company, its stock may still rise on news of acquisition anyway.

To sum, short-sellers bet on companies that are overvalued, the entire market is overvalued by historical standards, and there are many difficulties in identifying “problem companies”, particularly in today’s market. This brings us back to “Why would the most valuable brands in the world be prime short targets?”

Well, there are a variety of rationales to justify this. Investors are divided over the likelihood of a market correction, and while it doesn’t seem imminent, overvaluation of the entire market makes many quite skittish. When there is an inevitable correction, the stocks with higher betas, according to theory, should fall the hardest. Namely, tech stocks. There are also everyday investors pushing the prices of these “lottery” or “glamour” stocks higher, simply because they want to own shares in Amazon or Netflix, etc. This means the intrinsic value and price diverges further, creating larger potential profit for a short-seller. The “lottery” rationale can even be applied to short-sellers; imagine the profits they could reap if Tesla or Facebook actually declined massively! These were the thoughts as Tesla continued (and continues) to miss production targets, suffer human resource problems, and have questionable working capital sufficiency. Facebook is still dealing with data privacy issues, but material concerns are mostly put-to-rest from an investor’s perspective.

In the end, short-sellers short stocks, regardless of whether the company is little known or a market leader, because they feel there is a flaw in the market’s valuation. It could be perceived fraud, an overlooked metric, or a combination of factors that make the shorter feel the company is overvalued. The airing of these facts often leads to fights with management and long investors. While their positions tend to be difficult to justify, as they are contrarian by nature, that’s what makes them so intriguing. As a long investor, it forces you to wonder “what am I missing?” and “should I sell?”. In the end, only time will tell who is correct.

Sources:

Idzelis, Christine. “The Trade Is In. Now Try to Survive It.” Institutional Investor, Institutional Investor, 3 May 2018, www.institutionalinvestor.com/article/b180yh2b45mwlq/the-trade-is-in-now-try-to-survive-it.

Nocera, Joe. “Short Sellers Do Good, So Leave Them Alone.” Bloomberg.com, Bloomberg, 9 Feb. 2018, www.bloomberg.com/view/articles/2018-02-09/short-sellers-do-good-so-leave-them-alone.

ft Editorial Staff. “S&P 500: Stock Pricing vs. Earnings (P/E Ratio).” First Tuesday Journal, 2 Feb. 2018, journal.firsttuesday.us/tracking-the-market/1665/.

Sheetz, Michael. “Short Sellers Betting against Tesla Lose More than $1 Billion in Single Day as Stock Pops.” CNBC, MSN.com, 7 June 2018, www.msn.com/en-us/money/topstocks/short-sellers-betting-against-tesla-lose-more-than-dollar1-billion-in-single-day-as-stock-pops/ar-AAyj5O0?ocid=spartanntp.

St., 24/7 Wall. “The 6 Most Shorted Nasdaq Stocks.” MarketWatch, MarketWatch, 28 Feb. 2018, www.marketwatch.com/story/the-6-most-shorted-nasdaq-stocks-2018-02-28.

Dividend Channel Staff. “The 25 Most Shorted Stocks of the S&P 500 (Adsbygoogle = Window.adsbygoogle || []).Push({});” Dividend Channel, 1 June 2018, www.dividendchannel.com/slideshows/the-most-shorted-stocks-of-the-spx/.