401k Accounts and Market Crashes

Millennials are far more concerned about saving than previous generations were at the same age. This is influenced by a number of factors, primarily the Financial Crisis of 2008 occurring during our formative years. It also has some to do with student debt, which has crippled or pushed off many Millennials’ ability to save for a down payment. It’s natural then, that recent graduates immediately begin investing money for their (hopefully) eventual retirement in 401k accounts. Employers will often incentivize people to save and stay longer by matching a portion of the money employees contributed.

Now, there are many folks who do not have a finance background, but even those who do will sometimes get caught up in behavioral traps. I recently went to dinner with a group of my friends, and since we’re all in business or financial services, the conversation invariably moved to the economy. This is where I was shocked to hear a few common retirement saving misconceptions.

My one friend is very worried about the market ‘crashing’, and is considering moving his funds from his current mutual fund to bonds or a more conservative fund until the “crash occurs and the economy recovers”. This is likely a poor strategy. First off, market timing is incredibly difficult, if not impossible. Secondly, he will most likely lose some amount of return to fees by trading now and trading later. Lastly, conventional wisdom dictates that investors should adjust their risk to their time horizon. In this case, a retirement account has an extremely long investment period. Most early 20-somethings won’t be retiring for at least 40 years. This means that they could very easily invest 100% of their 401k accounts into broad index funds for the next 20 or 25 years, raking in the equity risk premium, before even having to consider putting a portion into fixed income securities.

Another posited that they might decrease their contributions during the crisis, and resume their larger contributions once “it’s over”. This is potentially much worse than changing the composition of your portfolio. First-off, contributing less will mean your employer (if there’s a matching program) will be contributing less to your portfolio. If you aren’t investing the maximum amount they’ll contribute, you are leaving free money on the table. Second, by contributing less during a market downturn, particularly to an index fund, you are essentially saying “I don’t want to buy the items while they are on sale”. However, this is a common mindset, albeit severely flawed. It is the exact opposite of what you should be doing during a downturn or stock market crash.

When the market “crashes”, we see assets decrease in price. Investor sentiment, consumer confidence, etc. will decrease, volatility usually increases, and this combines to force the entire stock market down. You, as an investor in the market, will see your portfolio lose value. It will probably lose the most value if it is 100% invested in the stock market. But let’s consider this. Its value today means nothing to you. You aren’t using the proceeds right now, nor do you need them for a number of years or decades. A simple mathematical example can demonstrate the effects of each mindset though.

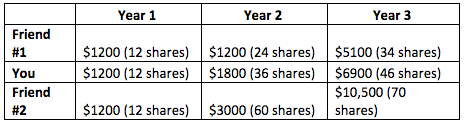

Let’s say you and your friends invest $100 each month in 401k accounts. Conveniently enough, there is also an index fund tracking the S&P500 with shares priced at $100. In year 1, you all buy 12 shares and each portfolio is worth $1200 at the end of year 1. We’re going to smooth the calculations here, for simplicity’s sake.

In year 2, the market crashes, due to war, trade wars, tech bubble, anything. It’s not important. What is important, though, is that the stock market dropped precipitously in the beginning of the year. Each share is now worth about $50, but your contribution is still set to $100. You and your friends have varying opinions on what to do. One decides to contribute $50 per month, you decide to invest $100, and your other friend is doubling their contribution to $200.

The market remains anemic in that year, and the index fund’s shares tended to trade at about $50 in year 2. At the end of year 2, Friend #1 owns 24 shares, you own 36 shares, and Friend #2 owns 60 shares due to her increased contributions.

Miraculously, in year 3, the market recovers very quickly, with your index fund averaging its previous price level of $100 during the first 6 months, and averaging $150 during the last 6 months. While none of you knew this would occur, you and your two friends decided to contribute $100 monthly in Year 3.

Well, let’s look at the account balances over the course of the three years:

Friend #2’s portfolio clearly benefited the most. She contributed extra money, of course, but the gain is disproportionate to that contribution. Your portfolio also reaped some of the same benefits, as your stable contributions did much better than Friend #1’s decreased contributions.

So, while we’ve covered some retirement planning tips for the young professional, the tip I’d like to emphasize the most is what the three friends did following the market move: reassessment. Now, of course, they didn’t seek a professional financial advisor’s help (which I would recommend speaking to a fiduciary if you’re investing), but they did reassess their situation. It’s important to periodically (every 6 months or full year) assess what your long-term financial goals are and how you are achieving them. During this time, you would look at the markets, your short-term financial position, and your portfolio to examine if a) your risk profile has changed, b) you’ve gotten a raise and can save more, c) the market has moved significantly, and a number of other factors. Your analysis could find that no change is necessary, but it’s good to know whether you’re still on the right track.

Sources:

Caplinger, Dan. “What to Do With Your 401(k) When the Market Crashes.” The Motley Fool, The Motley Fool, 18 Feb. 2018, www.fool.com/retirement/2018/02/18/what-to-do-with-your-401k-when-the-market-crashes.aspx.

Hopkins, Jamie. “3 Common Misconceptions About Retirement Planning.” Forbes, Forbes Magazine, 23 June 2016, www.forbes.com/sites/jamiehopkins/2016/06/23/3-common-misconceptions-about-retirement-planning/.