“And now we’re opening and we’re opening with a bang” 45th President Donald Trump stated in a June 5th press conference concerning the state of the economy upon state’s reopening, following month long closures due to the covid-19 outbreak. “This is better than a V” he continues, “this is a rocket ship, this is far better than a V” as he draws the shape of a V in the air with his finger. This statement came along with the pleasant surprise of reports revealing the national unemployment rate for the month of May had fallen to 13.3% from April’s 14.7%, a statistic economists worried would take much longer to return to any sort of normalcy. While it is certainly still much higher than February's rate of 3.5% before coronavirus was a household name, the 2.5 million jobs gained is certainly a step in the right direction.

The NASA and SpaceX Launch: Reigniting the Dream of Space

On Saturday May 30th, SpaceX launched the Falcon 9 rocket with the Crew Dragon Spacecraft to the International Space Station (ISS). The project was executed in conjunction with NASA, which provided SpaceX 2.6 billion dollars in funding for the launch (O'Callaghan). The event was seen as a proud moment for Americans across the nation for two reasons. The first being that the United States has fallen behind in the “Space Race” since the last NASA shuttle launch in July of 2011 when theAtlantis shuttle took off from the Kennedy Space Center with supplies for the ISS (Dunbar). The second was the innovations that have been made in the aerospace industry and the exciting work being done at the ISS.

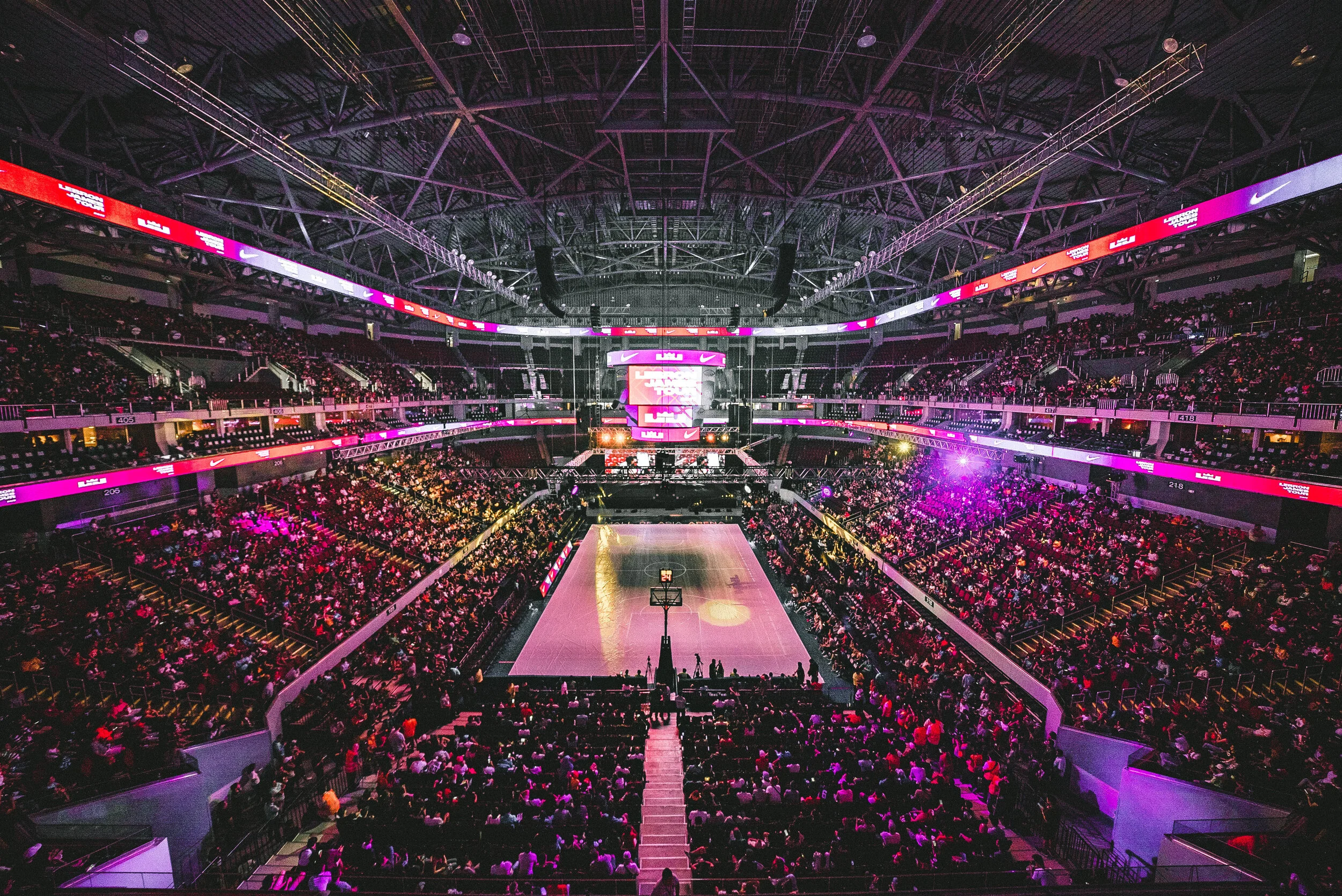

COVID-19 Results in Major Financial Losses for Major Sports Leagues

On March 11th, the National Basketball Association (NBA) made the decision to pause its season indefinitely after Utah Jazz player Rudy Gobert tested positive for COVID-19. After this decision was made, other leagues quickly followed suit, including major NCAA conferences such as the BIG 10, ACC, and SEC, which all made the decision to cancel their conference tournaments immediately despite the fact that some had already begun. Soon after, the NCAA made the decision to cancel the March Madness tournament, which has been held every year since its inception in 1939.

Three Decades Later and NASA’s Newest Space Telescope is Almost Functional

For the past couple of months, newsfeeds have been flooded with articles and information regarding COVID-19, and more recently the nation-wide tension and protests in the U.S. following the death of George Floyd. And yet, one piece of recent news was powerful enough to unify and rally an entire nation despite such bleak times. That piece of news was of course the successful launch and docking of the SpaceX Crew Dragon to the ISS. While this event was impactful enough to break into the stream of other issues being reported on at this time, many other remarkable scientific developments have occurred over the past couple of months and gone unnoticed because of other news stories at the time. Another space related enterprise that has recently reached significant, newsworthy milestones is the James Webb Space Telescope.

Solar Power Stock is a Strong Buy

Solar power has long been hailed as a sound alternative to fossil fuels and other non-renewable sources of energy. This alternative has witnessed exceptional growth in the United States and overseas and continues to play a role in our country’s energy mix. The Solar Energy Industries Association has announced that the U.S. installed 13.3 gigawatts (GW) in 2019 alone of solar photovoltaic (PV) capacity to reach 77.7 GW of total capacity, enough to power 14.5 million households. The energy source accounted for 40% of all new electric generating capacity added to the U.S. grid, higher than any other source (SEIA). As of February 2020, the industry employs more than 242,000 people and added $84 billion to the U.S. economy in 2016 (Rhodes). Furthermore, the U.S. Energy Information Administration projects solar to be the fastest-growing energy source until 2050 (EIA). As if that is not enough, the U.S. Bureau of Labor Statistics estimates that the solar PV installer will be the country’s fastest growing job until 2028, with a median income of $42,000. In other words, solar power no longer represents a mere fringe energy source; it is quickly becoming critical to U.S. energy and security. However, challenges remain that the industry continues to address as it becomes part of daily American life, including energy storage and effective market-incentivizing legislation.

The Battle Over Hong Kong and Currency Supremacy

Just as the world reached a ‘lull’ in the COVID-19 pandemic, China’s legislature introduced a new national security law to suppress “separatism,” “subversion,” and “terrorist activities” – bypassing Hong Kong’s Legislative Council (1). The details of this national security legislation are yet to be finalized, though it is reasonably foreseeable that the legislation will lead to Chinese security agencies operating in Hong Kong, the suppression of free speech, and a stricter legal system, as suggested by previous attempts at similar legislation (2). Such broadly defined legislation allows China to silence political resistance - signaling a great loss in Hong Kong’s autonomy and sovereignty. While this security measure is not expected to take effect until September 2020, the proposed legislation has already sparked international tension. This article examines Hong Kong’s importance to the global economy as well as the potential implications of US-China tensions on both nations’ currencies.

The Partisan Battle Over Covid-19

With almost four and a half million cases worldwide, covid-19 has swept the globe. The virus has ravaged destruction in every corner of the Earth. Without a known cure, the virus is endangering the life and health of virtually every single global citizen (Covid19 Coronavirus Tracker, 1). At this moment, the only known way to effectively limit the spread of the virus has been individual actions, including social distancing measures. However, the United States poses a unique challenge to these measures. Throughout the country, a partisan battle has emerged over how to best deal with the virus. In a time when individuals actions can dramatically shift the spread of the virus, it is imperative to have a unified collective effort while fighting the virus (Roberts, 1). Collective action in fighting the virus within the United States has been hindered by political differences and has limited the effective response capability of our nation.

Reopening: Buy or Sell?

Instead of a historically grim economic outlook decimating the stock market, the S&P 500 yielded a 31% increase since its trough on March 23. With the 2020 S&P 500’s high tallying just less than 3400, the market is making considerable progress back towards January highs. Never-before-seen volatility scared many investors into keeping much of their capital in cash, unaware of the extent to which COVID-19 would affect the future. This unprecedented event forced nearly all investors to continually question the bottom’s location. As states begin to reopen, it is worth questioning if buying stocks is the right move. Could the market be overpriced before the country reopens? Certain statistics are worth examining to determine a proper investment thesis regarding future long or short positions.

Necessary Developments in the Green Bond Market

The advancement of human technology, production, capital, and capability has grown significantly in recent history while driving the global economy to be what it is today. The countless benefits have raised contemporary issues, with the pending deterioration of the planet’s climate and overall environment at the forefront. Global growth has exponentially increased human footprint, as we see increases in carbon footprint and decreases in the health of the Earth and many of its species. Politics, businesses, and people have transitioned intentions to “be green”, collectively and individually; however, these sustainable actions are still outweighed by the environmental consequences of our increasing footprint. According to IBISWorld, a leading research platform in business intelligence, the oil and gas drilling sector - the most notorious plague to the Earth’s health - consumed $3.3 trillion USD in 2019. This is 3.8% of the $86 trillion USD global economy (IBISworld, 2020); and the list of industries that negatively affect the environment ensues beyond this sector. A relatively new financial tool, the green bond, is increasing in popularity that can benefit both economic and environmental well being.

Changing Trends in the Professional Workplace

Throughout the COVID-19 pandemic, nearly every sector has been affected in some way, mostly negative. What is very interesting though is how it affects the professional world, and many changes are likely to come, if they haven’t already. As a college business student, I am most intrigued and personally invested in how white-collar business is going to react in the next few years. Many businesses have been affected negatively, however, some are surprisingly changing for the positive.